Content Cloud for Financial Services

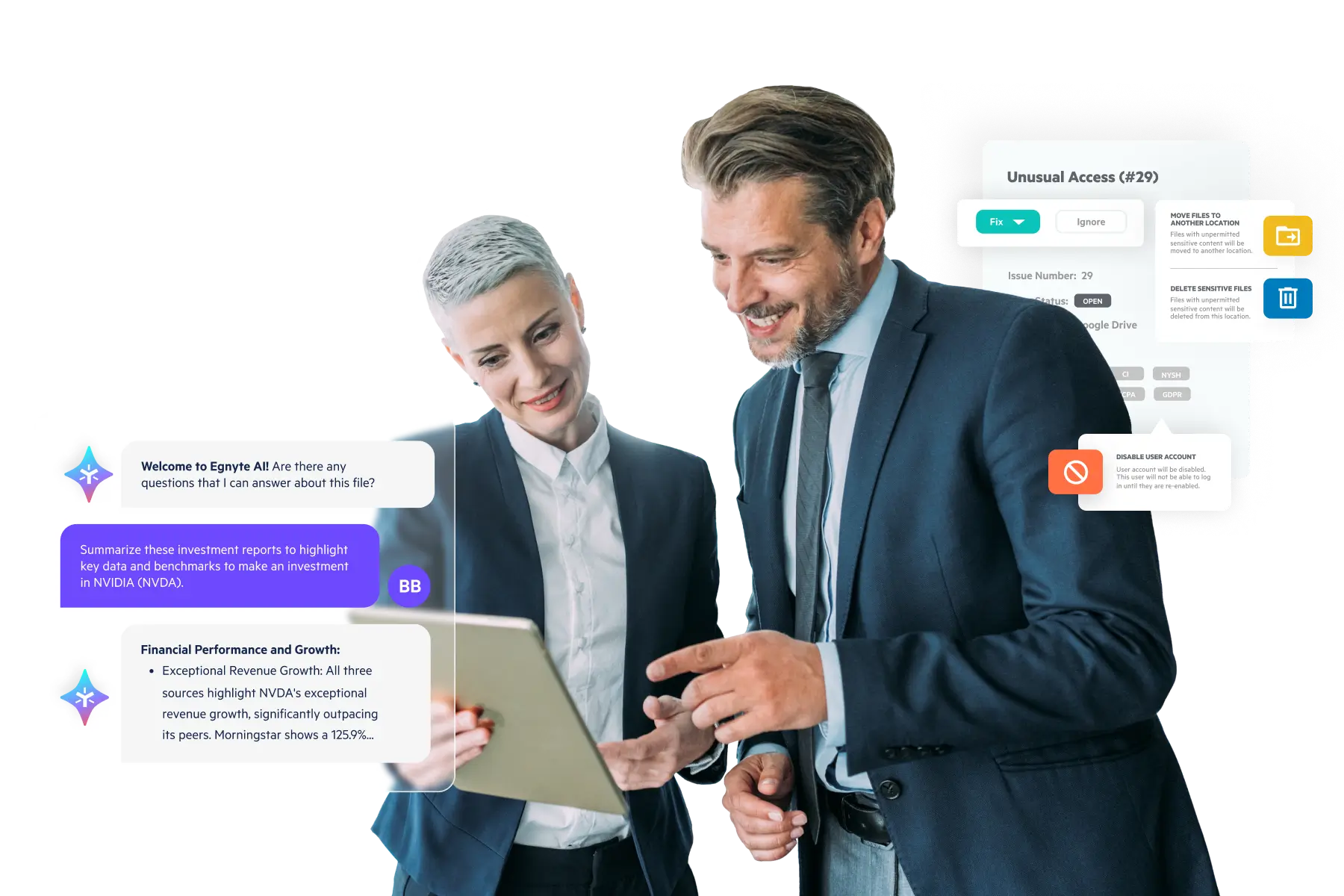

Streamline document workflows, leverage AI-driven document insights, and maintain compliance seamlessly in the content cloud.

Trusted by 22,000+ Content-Critical Businesses Worldwide

Unified Financial Services Document Management and File Sharing

Plans For Financial Services Companies of All Sizes

Business

- File Versioning

- Folder Templates

- Desktop and Mobile Access

- Single-Step Workflows

Enterprise Lite

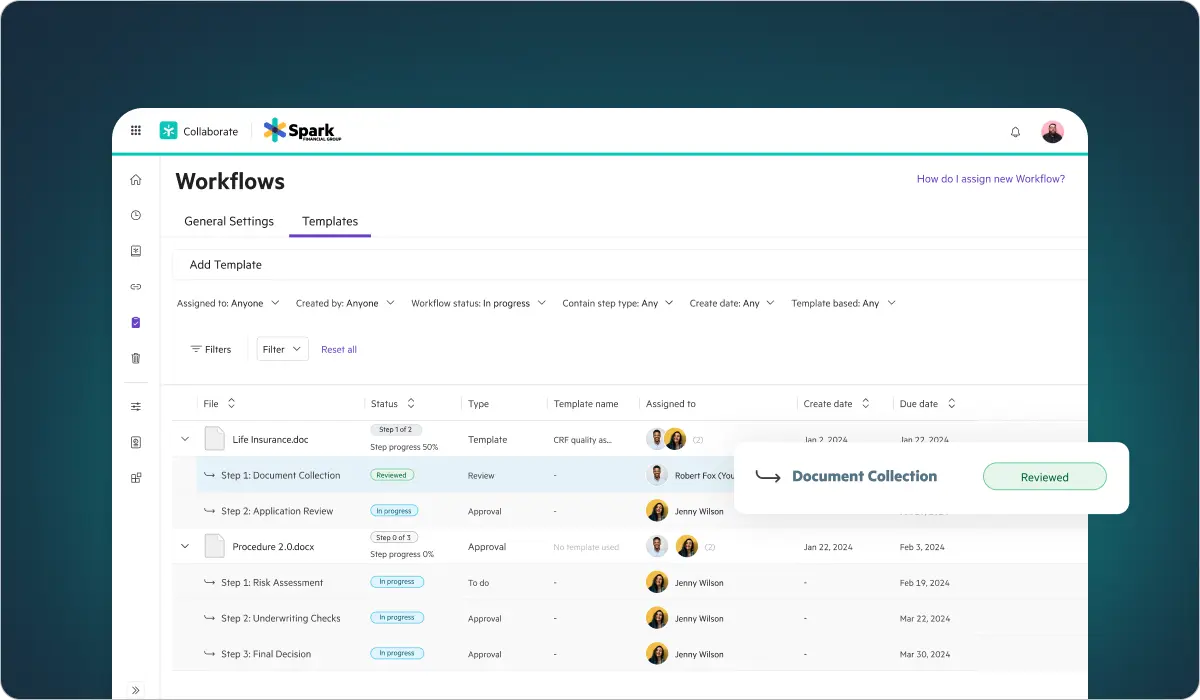

- Multi-setup Workflows

- Legal Hold

- Mobile & Desktop Device Controls

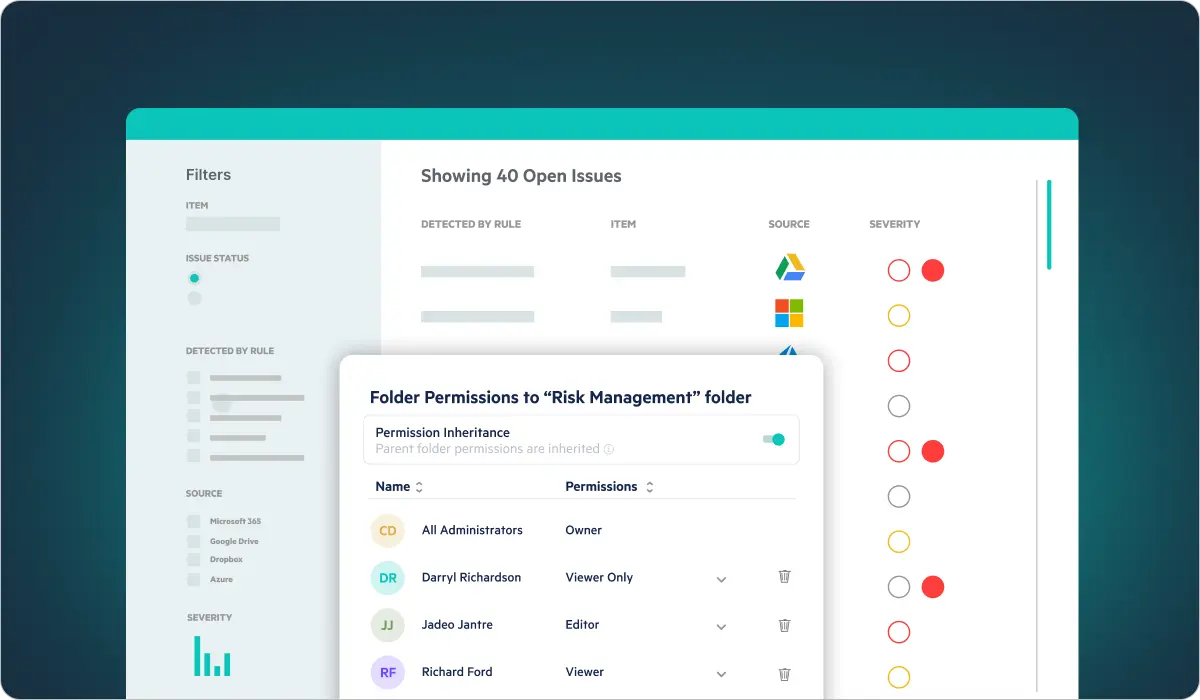

- Role-Based Access Control

Ultimate

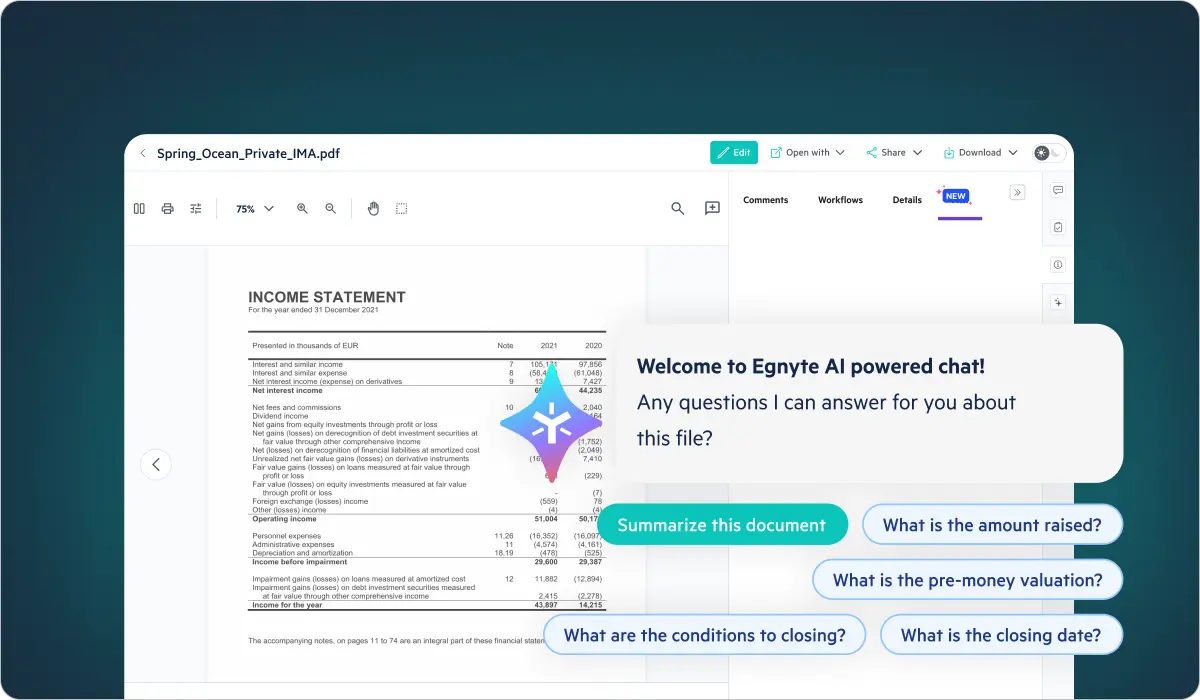

- AI Copilot, AI Search, and AI Workflow

- PDF markup and e-signature

- Sensitive data classification

- Snapshot & recovery (90-days)

Featured Solutions

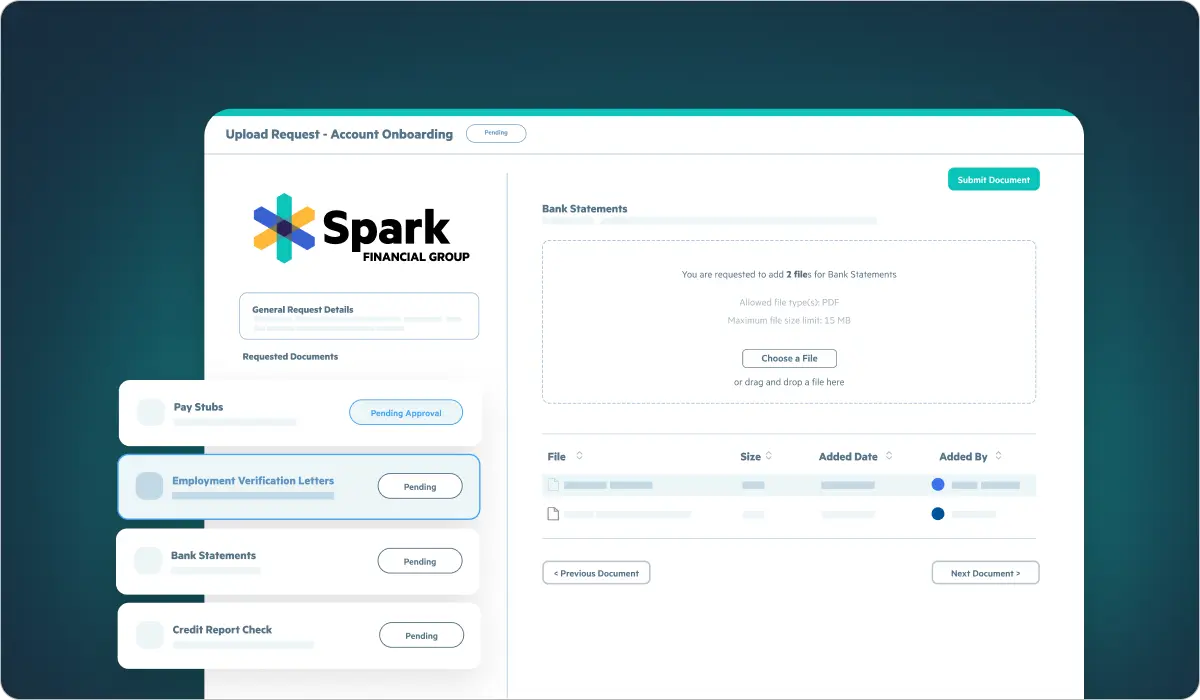

Document PortalSimplify and secure document requests, collection, and sharing for client onboarding, new account opening, and more.

Simplify and secure document requests, collection, and sharing for client onboarding, new account opening, and more.

Egnyte SignLegally binding electronic signatures directly in Egnyte workflow.

Legally binding electronic signatures directly in Egnyte workflow.

Document RoomProtect highly confidential files in an ultra-secure data enclave for M&A, capital raise, investor relations, and more.

Protect highly confidential files in an ultra-secure data enclave for M&A, capital raise, investor relations, and more.

Egnyte Supports Industry Associations

Trusted By Leading Financial Services Companies

Wealth Management

Learn how EP Wealth uses Egnyte to protect confidential client data and support secure file sharing.

Private Equity

Learn how Rockbridge maintains control over investment data with Egnyte’s AI-powered discovery and classification.

Insurance

Learn how UK-based PIB Group uses Egnyte to manage risk and protect data at its source.

Banking

Learn how SouthStar Bank controls the sharing of sensitive information without inhibiting organizational collaboration.