Regulatory Compliance

Regardless of industry or field, regulatory compliance is adhering to rules and standards that apply to processes, products, and policies. These rules and standards are put in place by governments as well as independent organizations to provide guidance for a group or industry that helps protect against damaging or dangerous practices. The drivers and enforcers of regulatory compliance vary according to where an organization is located, does its work, and produces its products or services.

To meet compliance requirements, organizations must implement practices that ensure that regulatory compliance is adhered to on a continuous basis. In most cases, systems must be in place to report on and prove compliance.

Regulations range from industry-specific to general mandates that apply to all organizations.

- Industry-specific regulations include:

- HIPAA for healthcare, which is enforced by the government

- PCI-DSS for payment card processors, which a trade group enforces

- Regulations that span all organizations in a geographic area include:

Why Is Regulatory Compliance Important?

Regulatory compliance is important because it protects all parties and properties related to an organization, including the organization itself. In all of its instantiations, regulatory compliance sets forth rules to guide decision-making and processes to ensure the best outcomes for all concerned.

While regulatory compliance helps organizations succeed, non-compliance can result in failure, fines, and other penalties. Following are several of the many reasons why regulatory compliance is important and how it can help.

- Can improve profitability

- Fortifies data protection

- Helps consumers build trust in an organization

- Prevents safety disasters

- Protects brands and reputations

- Provides guidance to attain goals safely and legally

- Regulates product specifications to ensure safety and efficacy

- Relieves directors and managers of liability

- Safeguards confidential and personal information

- Shields consumers from the consequences of actions carried out by organizations

- Unites public and private interests

Organizations and individuals that fail to meet regulatory compliance requirements can face:

- Damage to brand and reputation

- Disruption to service and operations caused by investigations or legal proceedings

- Individual penalties or jail time for individuals who intentionally violate the law

- Product recalls

- Substantial fines or penalties levied against the organization

- Suspension or loss of professional licenses

- Termination or suspension of services

Regulatory Compliance Implementation

A regulatory compliance implementation has many facets. Following are several considerations when implementing and maintaining a regulatory compliance program.

Compliance Audit

Before beginning a regulatory compliance implementation as well as once it has been set up, conduct a comprehensive audit to:

- Establish a regulatory compliance baseline

- Identify any issues or problem areas

- Assess all strengths and weaknesses—from human resources to security

- Uncover and measure risks, including the likelihood of occurrence and potential impact

Compliance Officer

Due to the importance of regulatory compliance implementation and maintenance, many organizations have established the role of a compliance officer, with responsibilities that include:

- Leading an organization’s programs to support and enforce corporate integrity, accountability, and ethics

- Overseeing the implementation and monitoring of a compliance program

- Staying up to date on the ever-evolving regulatory landscape

- Making updates to ensure compliance with new regulations

- Establishing and maintaining compliance-related policies and procedures to meet requirements and address issues identified in the compliance audit

- Conducting regular reviews of regulatory compliance policies to ensure that they continue to meet requirements

- Tracking employees’ recognition that they have read and understand regulatory compliance policies

Regulatory Compliance Training

For policies to be effective, regulatory compliance training is required. An effective training program includes:

- Ensuring that the workforce understands the importance of regulatory compliance and their role in adhering to requirements

- Clarifying the specific roles that employees have

- Reinforcing the importance of employees participation

- Providing refreshers on how and why everyone must participate

- Keeping the workforce updated on changes to regulatory compliance requirements

Ongoing Enhancements

After a regulatory compliance implementation, monitoring and maintenance are critical for the success of the program. This includes:

- Regularly scheduled review periods

- Defined timing and plan for regulatory compliance audits

- Continual tracking of regulatory changes and their impact

- Updates to meet changing needs and requirements

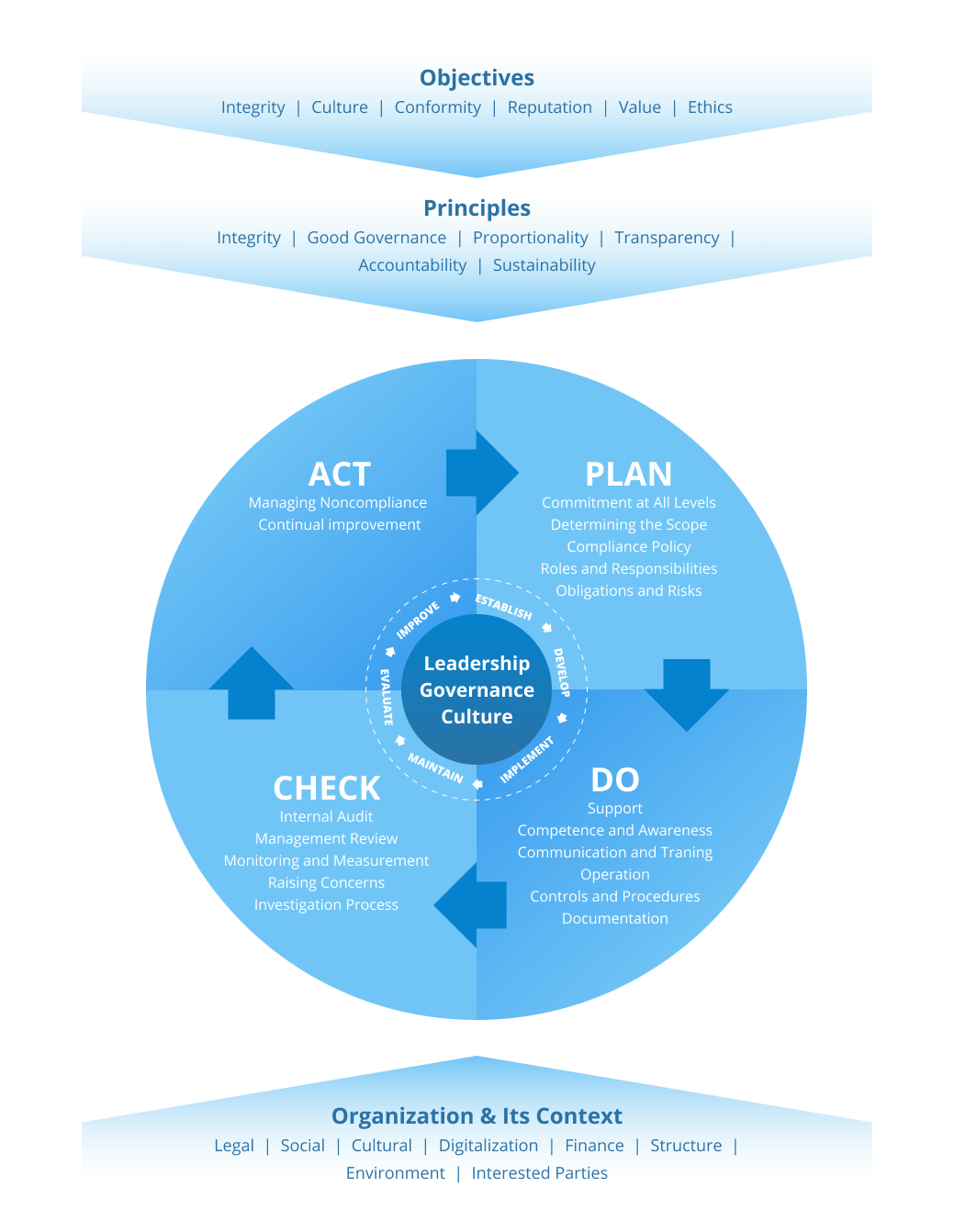

ISO 37301:2021, Compliance management systems— Requirements with Guidance for Use

Regulatory Compliance Challenges

Keeping Up with Changes to Regulatory Requirements

- New regulations that are released to address an evolving landscape

- Changes to existing regulations to address specific issues

- Need to quickly adapt infrastructure, policies, processes, and frameworks as changes are made

Showing Transparency and Accountability

- A requirement to comply with:

- Mandatory government regulations, such as GDPR, CCPA, and HIPAA

- Industry standards, such as PCI DSS, Good Laboratory Practice (GLP), and Good Clinical Practice (GCP)

- Maintain certifications, such as ISO 27001 for information security management systems and ISO 37301 for compliance management systems

- Ability to demonstrate and report on regulatory compliance

- IT resources required to support regulatory compliance programs

Changing Technology and Dynamic Environment

- Porous perimeters open organizations to vulnerabilities that impact regulatory compliance, such as:

- Bring your own device (BYOD) with unauthorized devices

- Internet of Things (IoT) with unsecured devices

- Cloud storage and applications without oversight

- Shadow IT with unauthorized storage and applications

- Mix of new and legacy systems create a patchwork of systems that are difficult to manage and secure

- Need to keep software up to date and install patches in a timely manner

- Interconnected devices that create network vulnerabilities by creating additional access points that can be exploited

- Expanding threat landscape with a growing number of high-risk digital and physical assets

Lagging Education and Increasing Cultural Barriers

- Workforce feels entitled to access any online applications from any device while connected to organizations’ networks, creating exposure points

- Difficulty getting everyone to realize the importance of regulatory compliance—from top leadership to staff and third parties

- Some training is in place, but it is not set up to support ongoing messaging about the importance of regulatory compliance and to share information about changes

- Lack of culture that values and takes responsibility for regulatory compliance and unwillingness to accept changes and adapt continuously to adhere to regulatory compliance requirements

Ensuring Compliance Across Supply Chain and Third Parties

- External parties must comply with regulations as part of an organization’s regulatory compliance program

- Distributed and complex supply chains hinder enforcement of regulatory compliance among vendors and partners

- Supply chains and third parties are often the weakest links and the cause of vulnerabilities and breaches

Data Breaches and Cyber Attacks

- Organizations are targeted for the large amounts of highly sensitive and personal data that they process and collect

- Internal errors—accidental and intentional ones—create vulnerabilities

- Complex and multifaceted environments make it difficult to ensure data protection

- Access controls must be implemented and maintained, especially removing users when access is no longer required

Common Compliance Regulations

Anti-Money Laundering (AML)

A collection of laws, regulations, and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income.

California Consumer Privacy Act (CCPA)

A data privacy law for California consumers that includes the right to know about the personal information a business collects about them and how it is used and shared and the right to delete personal information collected from them.

Children’s Internet Protection Act (CIPA)

A law that ensures K-12 schools and libraries have measures in place to protect minors from accessing harmful and inappropriate online content.

Children’s Online Privacy Protection Act (COPPA)

Focused on parents of children under the age of 13, this law decrees that operators of websites, mobile apps, and digital learning products must notify parents and obtain consent before collecting any personal information on their children.

Customer Due Diligence (CDD)

A rule that amends Bank Secrecy Act regulations to increase financial transparency and prevent bad actors from using companies to hide their illicit activities and launder money.

EU General Data Protection Regulation (GDPR)

A regulation that supersedes existing national data protection laws across the EU to provide a single data protection law that applies to any organization processing and storing EU residents’ personal data.

Family Educational Rights and Privacy Act (FERPA)

It protects the privacy of student education records, such as report cards, test results, and disciplinary records.

Federal Information Security Management Act of 2002 (FISMA)

A law that requires federal agencies to implement information security programs that ensure the confidentiality, integrity, and availability of their information and IT systems, including those provided or managed by other agencies or contractors.

Health Insurance Portability and Accountability Act (HIPAA)

A law that protects the confidentiality and security of healthcare information and makes it easier for people to keep their health insurance when they change jobs.

Know Your Client (KYC)

A rule for those in the securities industry who are dealing with customers during the opening and maintaining of accounts; this rule requires them to know and keep records on the essential facts of each customer, as well as identify each person who has authority to act on the customer’s behalf.

Payment Card Industry Data Security Standard (PCI DSS)

An industry standard that requires merchants to demonstrate that they have an IT security system that protects cardholder data, a vulnerability management program, access control measures, and protocols for testing networks for vulnerabilities.

Sarbanes Oxley Act (SOX)

A law that requires organizations to demonstrate corporate governance compliance as well as have management certify financial reports and the organization’s internal controls.

How Organizations Ensure Compliance

Some of the many ways organizations ensure compliance include the following; in addition to these, it is becoming more common to employ a person whose role is dedicated to regulatory compliance. As noted above, these compliance officers are responsible for understanding the regulatory landscape for their industry and the jurisdiction(s) in which they operate, as well as ensuring that the organization adheres to these requirements.

Stay current with an ever-changing regulatory landscape

- Proactively check for updated standards and regulations

- Understand new regulatory compliance requirements as they are released

- Update processes and procedures to meet new regulatory requirements

Document regulatory compliance policies and procedures

- Include requirements, along with related policies, processes, and procedures, in employee handbooks

- Share regulatory compliance materials in ongoing communications to the organization’s workforce

- Make documentation readily available

Consistently implement regulatory compliance programs

- Implement programs from the top down

- Make it clear that everyone in the organization is expected to adhere to regulatory compliance policies and procedures

- Do not allow any exceptions for adherence

- Include information about the organization’s regulatory compliance requirements and programs during recurring meetings and other events to reinforce it as a priority and embed it into the organization’s culture

Make sure everyone in the organization understands the importance of compliance

- Explain what regulations the organization must comply with and why

- Make clear how regulatory compliance is maintained across the organization

- Update employees when requirements change and explain the reasoning behind the update

- Share information about regulatory compliance in multiple ways as policies change

- Offer training around the changes

Require regulatory compliance training for everyone

- Reinforce compliance procedures and policies with regular training events

- Create and enforce schedules for workforce training

- Use a variety of media and approaches for training, such as videos, presentations, and games

Schedule compliance audits regularly

- Proactively identify incidences of non-compliance within the organization

- Test systems and processes to find out what is working and what can be optimized

- Conduct both announced and unannounced audits

Take advantage of technology to support regulatory compliance programs

- Automate compliance workflows and centralize management of compliance activities

- Monitor compliance in real-time

- Use systems that provide updates on relevant requirement changes or new regulations

Why Regulatory Compliance Is Indispensable

Regardless of size or industry, every organization is required to address some amount of regulatory compliance. All businesses must comply with the laws and regulations of the jurisdictions in which they operate or face penalties. As organizations increase in size and expand the scope of their activities, they are typically impacted by more regulations.

Ignorance is not a defense against regulatory compliance violations, so awareness and adherence are critical. Organizations have a variety of options for meeting requirements using internal resources or outsourcing. Be aware of the regulatory requirements that apply and take the necessary steps to adhere to them.

Egnyte has experts ready to answer your questions. For more than a decade, Egnyte has helped more than 16,000 customers with millions of customers worldwide.

Last Updated: 18th December, 2021